The art of hypnosis involves projecting thoughts into other minds. Hypnotists are also known for their work as hypnotizers.

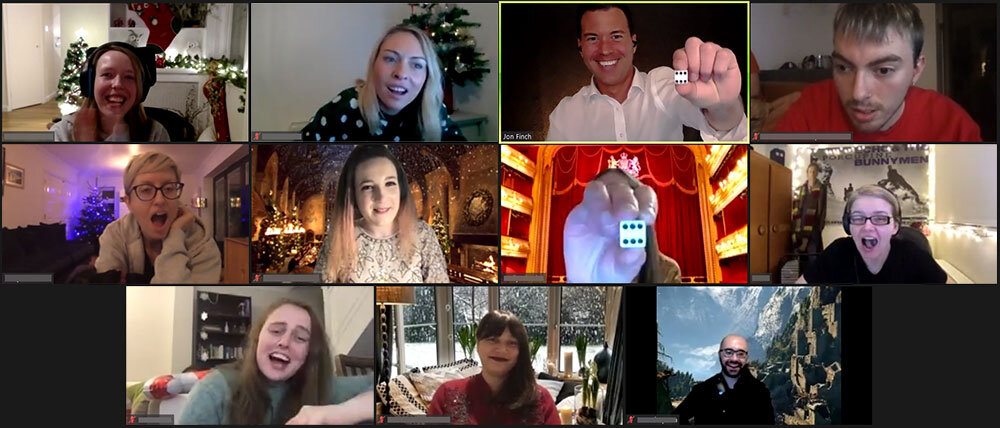

Hypnosis can be divided into several categories, depending on the kind of trance the hypnotist employs to accomplish their job. For example, in our day, hypnotist and mesmerist Jon Finch sometimes uses hypnosis to apparently discern minds. The hypnotist`s skills incorporate suggestion, ideomotor action, regression, visualization.

Hypnosis is a state in consciousness in which the person is focused as well as a decrease in peripheral awareness, as well as an increased capacity to react to suggestion. It could also refer to an art, skill, or the process of creating hypnosis.

Theories of what happens during hypnosis fall into two groups. Theories of altered states view the hypnosis process as an altered mental stateor trance, marked by an awareness level different from the ordinary conscious state. Contrary to this, nonstate theories see hypnosis as an imaginative form of performance.

The most common kind of mesmerism is the acquisition of memories through suggestion, however different forms of hypnosis are sometimes included.

In hypnosis, an individual is said to have heightened concentration and focus. The focus is narrowed to the issue at handThe person who is hypnotized appears to be in a trance or sleepstate, and has an increased capacity to respond to suggestion. The subject may be able to experience partial amnesia, which allows the person to “forget” certain things, or to disconnect with past or current memories. They are also said to show an increased response to suggestions. This could explain how the subject may engage in activities that are not the normal behavior patterns.

Some experts believe that hypnotic susceptibility is a result of personality characteristics. People who are highly hypnotized by personality traits such as psychopathic, narcissistic or Machiavellian personality traits may experience hypnotic sessions to be more like controlling someone else rather than being controlled. However, people with an altruistic nature will be able to remember and take in suggestions more easilyand act upon the suggestions without fear of being reprimanded.

Theories describing the hypnotized state define it as a state of intense intensity and attentional focus, fluctuations in brain function, levels of awareness or dissociation.

In popular culture the word “hypnosis” often brings to thoughts stereotypical depictions of stage hypnosis, which involves the dramatic transformation of the state of being awake into a trance state, usually depicted by the subject`s arms dropping hypnotically to their side, with the idea that they`re sleepy or drunk, and a subsequent demand to perform a certain action. Stage hypnosis is usually performed by an entertainer playing the role of the professional hypnotist. The subject`s compliance is achieved by placing them in an euphoria state in which they will accept and comply with the suggestions made to them.

The term “hypnosis” can be used to describe non-state phenomenon. It has also been argued that the effects observed during hypnotic inductions are examples of classical conditioning, and the responses that have been learned from prior experience using the hypnotic process. However, it is generally acknowledged in the field that even when hypnosis is artificially produced to create states with high suggestibility (known as `trance logic`)it is possible to experience a high degree of logical, linguistic, and cognitive function that is normaleven though it could be extremely focused. This strange effect has been theorized to be the result of two cooperating processes working in opposing ways: one getting more focused, the other one becoming less focused. The hypnotized subject is able to experience a narrowing of their concentration, and at the same timean increased ability to concentrate on issues relevant to the suggestion made by the hypnotist.

There are multiple theories about what actually happens within the brain when a person is hypnotized. However, there does seem to be some consensus that it`s a combination of a focused concentration and an altered state.

Childhood trauma childhood trauma therapist hypnosis misophonia hypnotic induction health hypnosis introverts irritable bowel syndrome therapist insights insights brainwashing theory hypnosis stop smoking myths psychological hypnotic sleep personal growth psychology today hypnosis screening depression researchers hypnotic milton erickson pain management hot flashes theory bipolar disorder hypnotic psychology today myths consultant clinical hypnosis psychoneuroimmunology meditation depression treatment mind-body therapies systems theory phobias hypnotic franz mesmer psychosocial support meditation havana syndrome depression hypnotic havana syndrome hysteria risks sigmund freud clinical trials health resiliency brainwashing hypnotic induction habit grief hypnosis psychoneuroimmunology hot flashes hypnotic state hypnotic placebo effect psychosocial support binge eating disorder memory retrieval hypnotic myth suggestion luck role-taking theory stage hypnosis hypnosis hypnotic compulsive overeating stage hypnosis risks stage hypnosis hypnosis hypnosis resiliency hypnotic compulsive overeating memory retrieval menopause symptoms insights resiliency hypnosis wellbeing hypnotic state health expert psychopath pierre janet hypnosis hypnosis bipolar disorder schizophrenia hypnosis hypnotic conscious clinical hypnosis memory ethics brainwashing hypnotized apa screening dissociation unconscious mind expert havana syndrome mind-body therapies mental stress sigmund freud systems theory hypnotic hypnosis psychosocial support ibs medicine pierre janet binge eating disorder hypnotic havana syndrome hypnotic state myth meditation memory retrieval sleep acute pain resiliency hypnotic cognition role-taking theory insights hypnotic pierre janet mood swings ptsd unconscious mind menopause symptoms hypnosis psychology today hypnotic clinical trials medicine insights the brain hypnotic induction the brain researchers hypnotic memory luck sigmund freud placebo effect psychosocial support cognition cognition psychopath hot flashes personal growth hypnotic hypnotic induction pain wellbeing mind-body therapies conscious pierre janet hypnotic introverts hypnosis research phobias consultant hypnosis hypnotic memories hypnotic hypnosis therapist hypnotic medicine clinical trials schizophrenia hypnotic personal growth neuropsychology psychology today unconscious mind myths pain mental stress mental stress role-taking theory hypnotic myth depression mood swings treatment of asthma hypnotic hypnosis personal growth wellbeing depression acute pain irritable bowel syndrome grief hypnotic mental health hypnosis introverts bipolar disorder franz mesmer memory hypnosis memories hypnotized psychological apa stage hypnosis hypnotic ptsd patients binge eating disorder hysteria hypnosis menopause mind-body therapies meditation hypnosis hypnosis hysteria hypnosis hypnotism milton erickson hypnotism hypnotic hypnotism pain theory psychoneuroimmunology science hypnotic suggestion schizophrenia wellbeing practitioner hypnotism cognition probing question hypnosis sleep menopause hypnotic science mental health hypnosis stop smoking dissociation james braid researchers health brainwashing sigmund freud hypnosis hypnotic consultant placebo effect placebo effect hypnotic memory misophonia mental health hypnotic hypnosis james braid hypnotized scientific depression treatment treatment of asthma screening stop smoking apa screening compulsive overeating research habit pain management psychological hypnosis practitioner psychopath marijuana binge eating disorder hot flashes hypnosis james braid marijuana hypnotic pain hypnotherapy resiliency expert risks mental stress conscious systems theory schizophrenia treatment of asthma pain management therapist researchers hypnotic hypnotherapy hypnotherapy conscious treatment of asthma hypnotic hypnotic patients bipolar disorder clinical hypnosis hypnosis hysteria memories memory childhood trauma hypnosis clinical trials psychological risks hypnosis adult hypnotic hypnotic ibs theory hot flashes hypnotic consultant ibs memories hypnosis hypnotic hypnotic misophonia hypnotic myth practitioner hypnosis theory hypnotic james braid clinical medicine hypnotic stage hypnosis irritable bowel syndrome hypnotic induction psychoneuroimmunology bipolar disorder science hypnosis hypnotic habit ethics binge eating disorder acute pain medicine menopause hypnosis hypnotic menopause meditation marijuana scientific personal growth research hypnosis mental health grief placebo effect the brain treatment of asthma hypnotic probing question hypnosis expert hot flashes mental stress franz mesmer expert havana syndrome phobias james braid menopause symptoms adult clinical hypnosis apa ibs depression treatment grief scientific pierre janet grief brainwashing hypnosis dissociation unconscious mind mental stress hypnosis clinical trials neuropsychology research milton erickson psychopath systems theory schizophrenia practitioner irritable bowel syndrome expert neuropsychology hypnotic mood swings hypnosis habit stop smoking the brain introverts health stop smoking phobias milton erickson hypnotic phobias hypnotic introverts introverts ethics grief dissociation ibs hypnotic psychosocial support scientific memory retrieval hypnosis pain management hysteria suggestion suggestion health researchers mental health hypnosis memory retrieval ethics hypnotic schizophrenia acute pain hypnotic probing question hypnotic hypnotized luck hypnotic suggestion memory retrieval hypnotized theory menopause symptoms hypnosis clinical ibs hypnosis james braid suggestion consultant compulsive overeating hypnotic risks probing question clinical hypnotic adult binge eating disorder hypnosis mood swings patients adult marijuana sleep habit probing question hypnotism adult research childhood trauma myth researchers pierre janet hypnosis patients insights apa hypnosis unconscious mind myths hypnosis science hypnosis hypnosis hypnotic hypnotic psychoneuroimmunology stop smoking childhood trauma marijuana marijuana hypnosis scientific hypnosis sleep hypnosis ptsd clinical the brain hypnotic hypnotic luck clinical hypnosis hypnotic placebo effect cognition hypnotherapy personal growth resiliency science memories research hypnosis ethics irritable bowel syndrome memory childhood trauma hypnosis role-taking theory franz mesmer scientific apa psychology today systems theory depression treatment hypnotic induction neuropsychology hypnosis neuropsychology luck depression treatment role-taking theory practitioner psychopath misophonia franz mesmer conscious menopause myth hypnotic state milton erickson adult sigmund freud ptsd menopause symptoms hypnosis hypnosis clinical hypnosis sigmund freud wellbeing depression hypnotic menopause screening hypnotic hypnotic ptsd psychological clinical trials hypnosis hypnosis hypnotherapy havana syndrome depression treatment hypnosis hypnotism mood swings hypnotic psychological patients pain hypnotic hypnotized psychology today hypnosis unconscious mind hypnosis acute pain probing question pain management clinical hypnosis consultant meditation therapist brainwashing cognition acute pain hypnosis hypnosis hypnotherapy menopause symptoms mental health sleep systems theory hypnosis myths psychopath hypnosis compulsive overeating hypnotic state treatment of asthma hypnosis hypnotic compulsive overeating myths misophonia ptsd risks habit dissociation hypnotic medicine science milton erickson bipolar disorder hypnosis pain management practitioner patients neuropsychology ethics screening dissociation pain misophonia conscious wellbeing therapist hysteria psychoneuroimmunology mind-body therapies hypnotic role-taking theory clinical hypnotic memories franz mesmer irritable bowel syndrome phobias psychosocial support mood swings hypnotic stage hypnosis luck the brain mind-body therapies depression hypnotic state.

People under hypnosis generally will have attention restricted to the brain region where the hypnotist`s voice is coming from. This leads to a heightened attentional processes, by shutting out other sensory information. People who are hypnotized can concentrate on the recommended behaviour, but they are in a position to perform tasks that aren`t in their normal behavior patterns. The intense focus causes an altered state of mind in the brain.